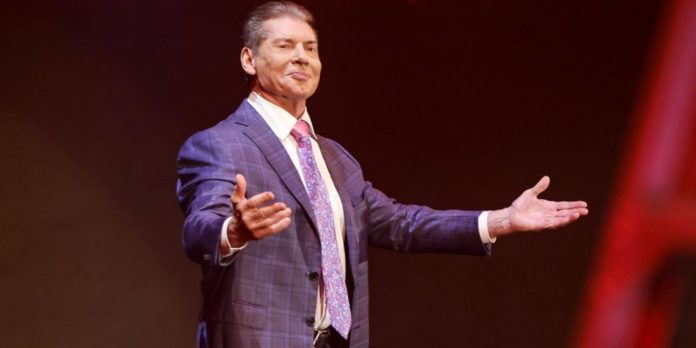

The Board of Directors investigation into former WWE Chairman & CEO Vince McMahon and Vince’s actual departure, according to WWE’s quarterly filing with the SEC, may harm the business in a number of different ways.

The investigation may have a substantial adverse effect (MAE) on the company’s financial performance, according to the filing. Additionally, it was mentioned that Vince’s resignation might negatively impact WWE’s capacity to develop well-liked characters and creative storylines, as well as WWE’s operational outcomes.

The SEC filing includes the following:

“The Company’s recent Special Committee investigation could result in a material adverse effect on our financial performance.

On June 17, 2022, the Company and its Board of Directors announced that a special committee of independent members of our Board of Directors (the “Special Committee”) was formed to investigate alleged misconduct by the Company’s former Chairman and Chief Executive Officer, Vincent K. McMahon. The Special Committee investigation is substantially complete. Mr. McMahon resigned from all positions held with the Company on July 22, 2022 but remains a stockholder with a controlling interest. On July 25, 2022, based on the findings of the Special Committee investigation, the Company announced that it had determined that certain payments that Mr. McMahon agreed to make during the period from 2006 through 2022 (including amounts paid and payable in the future totaling $14.6 million) were not appropriately recorded as expenses in the Company’s Consolidated Financial Statements. The Company subsequently identified two additional payments totaling $5.0 million, unrelated to the alleged misconduct by Mr. McMahon that led to the Special Committee investigation, that Mr. McMahon made in 2007 and 2009 that were not appropriately recorded as expenses in the Company’s Consolidated Financial Statements. Together, these unrecorded expenses total $19.6 million (the “Unrecorded Expenses”). All payments underlying the Unrecorded Expenses were or will be paid by Mr. McMahon personally. The Company has determined that, while the amount of Unrecorded Expenses was not material in any individual period in which the Unrecorded Expenses arose, the aggregate amount of Unrecorded Expenses would be material if recorded entirely in the second quarter of 2022. Accordingly, the Company is revising its previously issued financial statements to record the Unrecorded Expenses in the applicable periods for the years ended December 31, 2019, 2020 and 2021, as well as the first quarter of 2021 and 2022. In light of the Unrecorded Expenses and related facts, the Company has concluded that its internal control over financial reporting was not effective as a result of one or more material weaknesses. The Company has also received, and may receive in the future, regulatory, investigative and enforcement inquiries, subpoenas or demands arising from, related to, or in connection with these matters. Professional costs resulting from the Special Committee’s investigation have been significant and are expected to continue to be significant as the investigation continues and/or if litigation costs relating to these regulatory, investigative and enforcement inquiries, subpoenas and demands grow. Although we believe that no significant business has been lost to date, it is possible that a change in the perceptions of our business partners could occur as a result of the investigation. In addition, as a result of the investigation, certain operational changes including without limitation personnel changes have occurred and may continue to occur in the future. Any or all of these impacts based on the findings of the investigation and related matters and the surrounding circumstances could exacerbate the other risks described herein and directly or indirectly have a material adverse effect on our operations and/or financial performance.

The resignation of Vincent K. McMahon could adversely affect our ability to create popular characters and creative storylines or could otherwise adversely affect our operating results.

Until he resigned from all positions held with the Company on July 22, 2022, in addition to serving as Chairman of our Board of Directors and Chief Executive Officer, Mr. McMahon led the creative team that develops the storylines and the characters for our programming (including our television, WWE Network and other programming) and live events. On July 22, 2022, the Board appointed Stephanie McMahon, at that time Chief Brand Officer, interim Chief Executive Officer, interim Chairwoman and a director of the Company, and Nick Khan, at that time President, Chief Revenue Officer and a director of the Company, to serve as the Company’s co-Chief Executive Officers. The Board has also appointed Stephanie McMahon to serve as the Company’s Chairwoman. Furthermore, in the wake of Mr. McMahon’s departure, our creative effort will be led by Paul Levesque, the Company’s Executive Vice President, Talent Relations and Creative and Ms. McMahon’s husband, who has decades of experience in our Company and has been an important player in all aspects of our creative process, including television, talent and live events. Although Mr. Levesque has extensive practical experience with many of our revenue streams and, with Ms. McMahon, has been critically involved in our business transformation over the past several years as well as our continuing brand development, these collective changes at the top of our organization are extensive and recent, and it is therefore possible that the loss of services of Mr. McMahon could have a material adverse effect on our ability to create popular characters and creative storylines or could otherwise adversely affect our operations and/or financial performance.

Failure to remediate a material weakness in internal accounting controls could result in material misstatements in our financial statements.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, as amended, our management is required to report on, and our independent registered public accounting firm is required to attest to, the effectiveness of our internal control over financial reporting. The rules governing the standards that must be met for management to assess our internal control over financial reporting are complex and require significant documentation, testing and possible remediation. Annually, we perform activities that include reviewing, documenting and testing our internal control over financial reporting. In addition, if we fail to maintain the adequacy of our internal control over financial reporting, we will not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002. If we fail to achieve and maintain an effective internal control environment, we could suffer misstatements in our financial statements and fail to meet our reporting obligations, which would likely cause investors to lose confidence in our reported financial information. This could result in significant expenses to remediate any internal control deficiencies and lead to a decline in our stock price.

Subsequent to the Original Filing, management of the Company evaluated immaterial accounting errors related to certain payments that Mr. McMahon, the Company’s former Chairman and Chief Executive Officer, who resigned from all positions held with the Company on July 22, 2022 but remains a stockholder with a controlling interest, agreed to make during the period from 2006 through 2022. The Company determined that these payments (including amounts paid and payable in the future totaling $14.6 million) were not appropriately recorded as expenses in the Company’s Consolidated Financial Statements. The Company subsequently identified two additional payments totaling $5.0 million, unrelated to the alleged misconduct by Mr. McMahon that led to the Special Committee investigation, that Mr. McMahon made in 2007 and 2009 that were not appropriately recorded as expenses in the Company’s Consolidated Financial Statements. Together, these unrecorded expenses total $19.6 million (the “Unrecorded Expenses”). The Company has evaluated the Unrecorded Expenses and has determined that such amounts should have been recorded as expenses in each of the periods in which they became probable and estimable.

As a result of the accounting errors, the Company has re-evaluated the effectiveness of the Company’s internal control over financial reporting and identified material weaknesses in the Company’s internal control over financial reporting as of December 31, 2021 and March 31, 2022. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of a company’s annual or interim financial statements will not be prevented or detected on a timely basis. For further discussion regarding the accounting error and the correction of such error to the Company’s previously issued Consolidated Financial Statements, see Note 22, Revision of Previously Issued Consolidated Financial Statements, to the Consolidated Financial Statements of the Company included in the Company’s Form 10-K/A.

Our management may be unable to conclude in future periods that our disclosure controls and procedures are effective due to the effects of various factors, which may, in part, include unremediated material weaknesses in internal controls over financial reporting. For further discussion of the material weaknesses, see Item 4, Controls and Procedures. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by a company in those reports is accumulated and communicated to the company’s management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure.

Management is committed to maintaining a strong internal control environment and believes its remediation efforts will represent an improvement in existing controls. Management anticipates that the new controls, as implemented and when tested for a sufficient period of time, will remediate the material weaknesses. We may not be successful in promptly remediating the material weaknesses identified by management, or be able to identify and remediate additional control deficiencies, including material weaknesses, in the future. If not remediated, our failure to establish and maintain effective disclosure controls and procedures and internal control over financial reporting could result in material misstatements in our financial statements and a failure to meet our reporting and financial obligations, each of which could have a material adverse effect on our financial condition and the trading price of our common stock.”