The future of WWE’s extensive video library and NXT Premium Live Events is beginning to take shape as the company prepares for the expiration of its current U.S. streaming agreement.

Since 2021, WWE’s on-demand library has been housed on Peacock in the United States. That five-year deal is scheduled to expire at the beginning of 2026. While speaking at the UBS Global Media and Communications Conference, TKO COO Mark Shapiro provided insight into how WWE plans to handle its archive moving forward.

According to Shapiro, WWE is no longer focused on a single-platform arrangement for its historical content. Instead, the company is actively pursuing a non-exclusive distribution strategy.

“We’re working on a non-exclusive deal at the moment,” Shapiro said, adding that WWE expects to have “something to announce” in the first quarter of 2026.

This approach aligns with new reporting from the Wrestling Observer Newsletter regarding how WWE’s archives could be divided across multiple platforms. Dave Meltzer reported that discussions have centered on splitting content by era and brand.

“The talk right now is the old territories video library would be uploaded on YouTube slowly,” Meltzer wrote. “Some of the content such as SmackDown archives as well as Saturday Night’s Main Events would stay on Peacock. Old Raws may go to Netflix, which has uploaded them internationally, but far from complete libraries.”

Shapiro also addressed the status of NXT Premium Live Events, which currently stream on Peacock. While WWE’s main roster PLEs are set to move domestically to ESPN beginning in 2026, the future home of NXT’s major events has not yet been finalized. Shapiro noted that WWE is taking a measured approach, emphasizing that the company wants to be “deliberate and thoughtful” as it evaluates its options. The current deal for NXT PLEs expires in March 2026.

During the discussion, Shapiro also floated a potential future scenario tied to ongoing changes in the media landscape. He suggested that corporate mergers could open new doors for WWE’s developmental brand.

“If Paramount can get WBD, I like a world where we could potentially live on HBO or TNT,” Shapiro said, noting that both platforms are established destinations for sports and live programming.

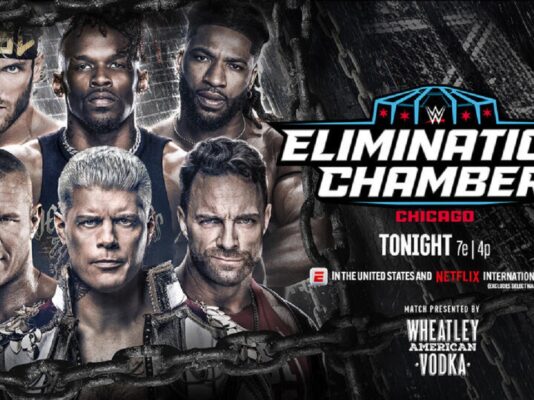

These comments come amid a major reshaping of WWE’s media rights portfolio. The company has already secured a domestic deal with ESPN for main roster Premium Live Events and a landmark agreement with Netflix for Monday Night Raw, signaling a more fragmented but potentially broader distribution model moving forward.