According to reports from Deadline and The Wrap, Netflix has won the bidding war for Warner Bros. Discovery (WBD) and is set to begin exclusive talks to finalize the deal.

Initially, Netflix was not seen as a likely bidder for WBD, especially after the company became an acquisition target for Paramount in September. Netflix had previously indicated that it was not interested in mergers and acquisitions. However, this stance changed in late October.

WBD attracted interest from several suitors, including Paramount, Netflix, and Comcast. Paramount aimed to acquire the entire company, while Netflix and Comcast focused only on the studios and streaming division, excluding the networks. WBD announced plans to split the company in June.

Paramount made multiple offers that were rejected before WBD opened the bidding process in November. Recently, tensions escalated when Paramount sent a letter to WBD criticizing Netflix and Comcast as potential buyers. Paramount described the bidding process as “unfair” and biased towards Netflix, asserting that they would have an easier path to regulatory approval. Nonetheless, WBD remained undeterred by these claims. Sources from The Wrap indicated that Netflix offered approximately $28 per share for WBD, primarily in cash.

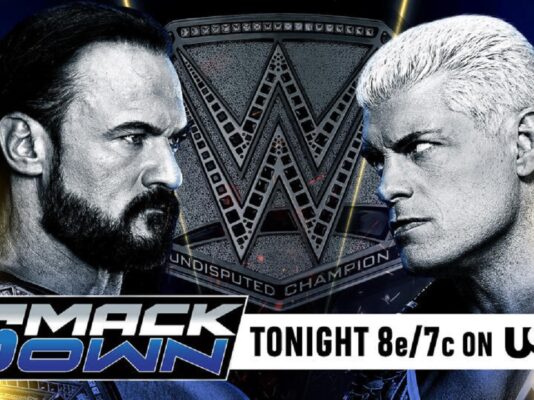

This situation raises questions in the wrestling world regarding the future of AEW, as Netflix has an existing partnership with WWE while WBD serves as AEW’s home network. While Netflix is expected to acquire HBO Max and Warner Bros. Studios, it will reportedly not acquire the networks. AEW is currently in a multi-year deal with WBD that allows it to simulcast on TNT/TBS and HBO Max, with AEW pay-per-views offered at a discount on HBO Max. Additionally, Paramount has a deal with TKO to broadcast UFC events on Paramount+ starting next year.

It is important to note that exclusive talks do not guarantee a finalized deal, and the regulatory process is likely to be complex. Paramount could potentially present its own offer directly to WBD shareholders if it chooses to escalate the situation. However, it remains unclear whether Paramount could match WBD’s offer if it opted for this approach. According to CNN, Paramount had previously offered $27 per share, but only for the entire company. Should the deal close, it is expected to reshape the entertainment industry, both positively and negatively significantly.